Have you ever sold tickets on StubHud or TicketExchange and were unaware of the additional fees is cost just to sell those tickets?

Today I’m going to dig into the seller side of closing costs.

Are you a buyer? I went into depth on buyer closing costs in a previous post – check it out here.

Seller Closing Costs

Hey there seller! What are these “closing costs” you are always hearing about!?

The seller side is a little simpler than the buyer’s end of closing costs but there are still fees you need to be aware of. The goal is to know well ahead of time what you are taking away when you sell your home.

Seller closing costs consist of :

- Realtor Fees

- Title Fees

- Any buyer’s closing costs you agree to cover

All three of these will vary from offer to offer depending on the buyer. Let’s dig into each in more detail.

Realtor Fees

Your Realtor fees are the fees you agreed to pay to both your listing agent and the agent that brought the buyer at the act of sale.

This will vary from agent to agent so be clear ahead of time what you have agreed to with your agent. Typically in the New Orleans area Realtor fees are around 6% of your contract price.

Title Fees

Title fees are typically minimal but they are still fees you should be aware of. The buyer will choose the title company for the sale.

The seller title fees consist of: a recording fee for mortgage cancellation (if you have a mortgage), pay-off overnight fee, release of mortgage fee, and settlement fee.

Now this sounds like a lot but typically I tell my sellers to estimate $1000 for all of this. This is on the higher side, but its a good round number to consider.

Keep in mind, if you have liens and complexities the title company has to work through in order to provide a clear title to your buyer, the fees could be m0re

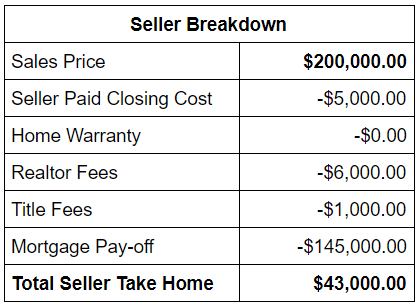

Sample Seller’s Breakdown

When I get an offer for one of my seller’s I usually send a breakdown similar to this one so they can see all of the associated expenses and the most important number – the take home amount they will walk away wit

Covering a Buyer’s Closing Costs

You may be asked to pay some of the buyer’s closing costs. Buyers typically do this when they are short on cash as a way to finance their closing costs. You can read more about what they are expected to cover in my previous post.

I advise my sellers to not get wrapped up “paying for their closing costs” if they ask for it, but to focus on your bottom line or seller proceeds from the sale. Use the breakdown I shared above as a guide to help you figure out your bottom line

If you have an offer you want to make work and still hit your take home number, adjust your counter offer accordingly.

That’s it!

Each sale is different – if you want to walk through your personal seller situation with me send an email to robyn@robynsbruno.com.

I’d love to hear from you!